Adding it all up

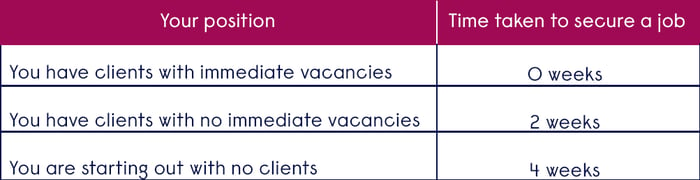

Now it's time to calculate the total amount of money you need in the bank before launching your recruitment business. Let's assume it will take you two weeks to secure your first vacancy, four weeks to fill it, four weeks for the candidate to start, and an additional four weeks to receive payment. This makes a total of 14 weeks, equivalent to three and a half months.

Bear in mind that these figures are based on an established recruiter with a solid client base who has reasonable terms with their clients. By adding your monthly operational costs and monthly compensation together, you can then multiply the sum by three and a half months (or a duration you believe is reasonably required to start earning). This calculation will give you an estimate of the total amount of money you need to have in the bank before launching your recruitment business.

Recommendations from Reed Franchise Partnerships

At Reed Franchise Partnerships, we recommend having a minimum of four months' worth of coverage for operational costs and compensation if you are in the USA, where notice periods tend to be shorter. If you are operating in a market where notice periods align more closely with the European standard of three months, we advise having six months' worth of coverage.